Battle of the Brands: Fitness Edition

David Lloyd vs PureGym – the data-fueled fitness showdown

Meet two heavyweight gym brands on opposite ends of the market. David Lloyd Clubs is the premium leisure haven (think tennis courts and spa towels), while PureGym is the no-frills, 24/7 fitness giant.

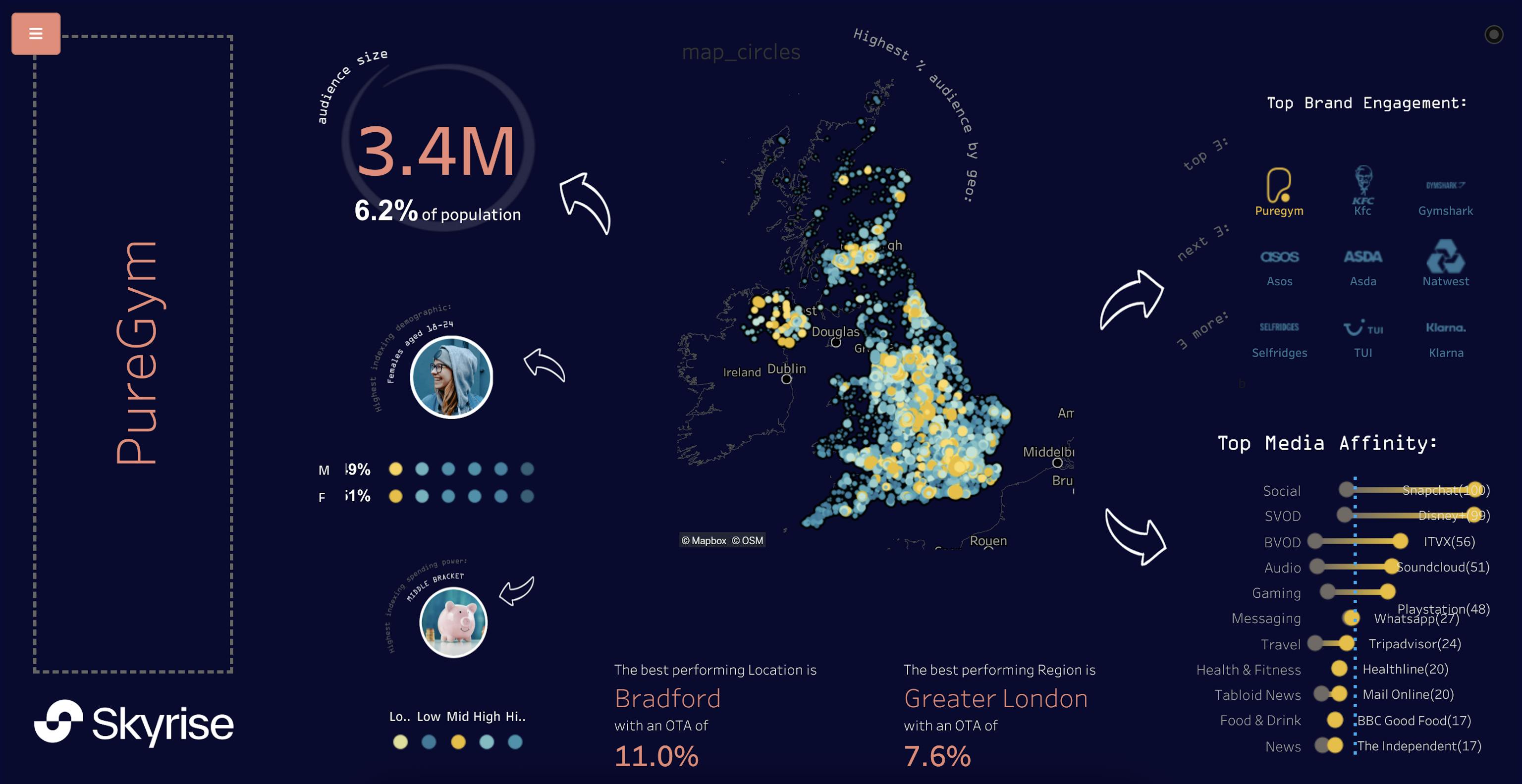

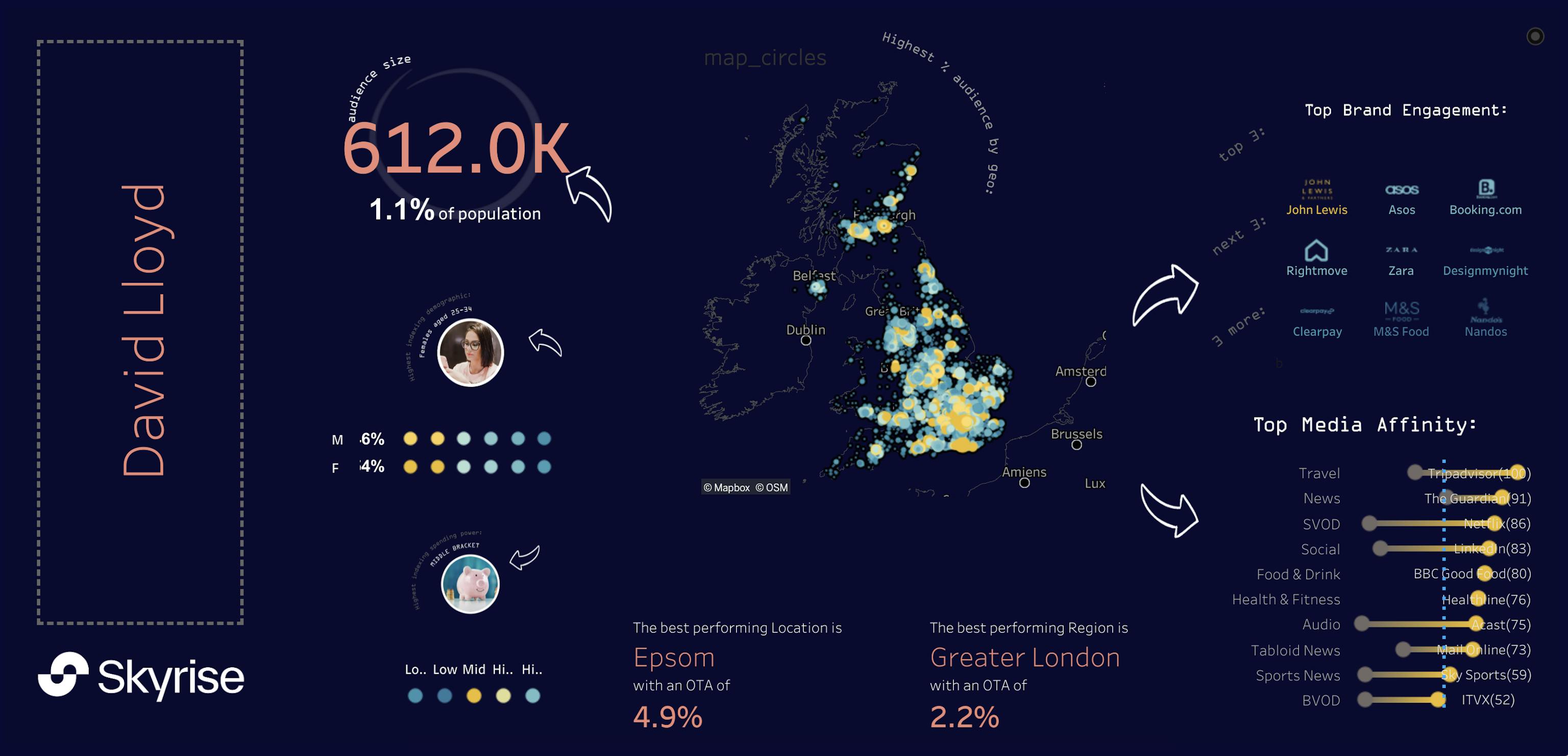

Why compare them? Because they’re vying for the same fitness spend – and their audiences couldn’t be more different. In our geo-temporal analysis, PureGym’s tracked audience is 5.5× larger than David Lloyd’s (3.4M vs 0.61M), reflecting PureGym’s mass-market reach.

But bigger doesn’t mean identical: we’re about to see how a budget gym’s crowd and a premium club’s members diverge in where they live, what brands they love, and how they consume media – proving that understanding these nuances is key for marketers. Buckle up for some data-driven insights that challenge a few fitness marketing assumptions.

Geo Showdown: North vs South, Urban vs Suburban

Location matters. PureGym’s audience is city-centric – they over-index in urban hubs, especially in the North. For example, they’re 2.3× more likely to hail from Leeds or Bradford than the national average. Manchester and Liverpool also punch above their weight. In contrast, David Lloyd’s crowd is rooted in the affluent suburbs and smaller towns. Their top hot-spot isn’t a big city at all but Kings Hill in Kent (a commuter town) with an off-the-charts presence (~12× index!). Other David Lloyd strongholds include upscale or suburban areas like Battersea in London and Eastbourne on the south coast – places with driveways for those BMWs and time for a tennis set.

Both brands have a footprint in London, but interestingly neither dominates the capital: they under-index in central London (likely due to fierce competition and differing target demos). The takeaway? PureGym owns the urban North, while David Lloyd thrives in suburban South (and pockets of the North too, like Leeds’ affluent Moortown) – a geographic split that should inform any regional marketing strategy.

Lifestyle & Shopping Habits

When it comes to brand affinities, the personalities of these audiences diverge sharply. PureGym’s fans show a penchant for value and convenience – their top affinities include fast-food and athleisure. (Yes, this budget gym crowd hits the weights and then hits the drive-thru!). KFC is literally PureGym audience’s #2 affinity (indexed ~5.7× vs average)[7], with McDonald’s not far behind – indicating a cheeky post-workout cheat meal vibe. They’re also into sports fashion on a budget: Gymshark and JD Sports rank high for PureGym folks. In fact, JD Sports is a key retailer for them, whereas it’s far less prominent for the David Lloyd set]. The PureGym tribe also over-index on discount grocery and high-street retail: for instance, they lean toward Asda supermarkets (about 2.6× more likely) and snap up fast-fashion like PrettyLittleThing. It’s an active, cost-conscious lifestyle – heavy on takeaways, activewear, and affordable indulgences.

Now enter David Lloyd’s audience – a different breed with a premium lifestyle. Their top affinity is John Lewis (premium department store) – David Lloyd members are 3.3× more likely to shop there. They’re also big on travel and finance: brands like British Airways and even Klarna/Clearpay (buy-now-pay-later for those luxe buys) pop up for them. Notably, this crowd shows a taste for finer foods: M&S Food halls and Waitrose appear in their affinity list (far more than in PureGym’s).

In dining, a sit-down meal or trendy restaurant is on the menu – they index higher for using OpenTable reservations and devouring content from BBC Good Food (more on that later). That said, they’re not complete health saints – Nando’s is a mutual guilty pleasure for both groups, proving even tennis club members love a spicy chicken fix.

The big picture: PureGym’s audience skews young, cost-conscious, and convenience-driven, while David Lloyd’s skew older, affluent, and lifestyle-oriented. Marketers, take note – a one-size-fits-all brand partnership (or tone of voice) would miss the mark here.

Where They Get Information & Entertainment

Different habits extend to media consumption. PureGym’s crowd lives and breathes digital entertainment and social media – truly a mobile-first audience. Their number-one affinity in media? Snapchat – they are ~3.2× more likely to be found on Snap than the average person. They’re also heavy users of TikTok (no surprise for a younger demo) and streamers: the PureGym cohort over-indexes strongly on emerging streaming platforms like Disney+ (~3.3×), Now TV, Paramount+, and Discovery+. Bingeing the latest Marvel series or reality TV? Highly likely for them. They also show a penchant for gaming and geek culture – platforms like PlayStation and Reddit make their list, as does SoundCloud for music. In short, the PureGym audience is plugged in and always online: if you want to reach them, think Instagram stories, YouTube pre-rolls, influencer Reels, and ads on streaming apps – traditional print or even legacy news sites will get less traction.

Meanwhile, David Lloyd’s media diet is more old-school with a modern twist. This group leans into quality news and knowledge sources. They over-index on The Guardian website (~2.5×) and even The Times (3.4×) – signaling a more educated, professional cohort that likes its news broadsheet flavored. They’re significantly more active on LinkedIn too (1.8×), aligning with the career-minded profile of many David Lloyd members. And while they do stream TV (Netflix usage is high among them as well), they’re also into niche content and enrichment: note the strong affinity for Acast (for podcasts) and Healthline (a health information site). They also consume mainstream media, but in a balanced way – e.g. moderately above average on Facebook and Sky News.

And in a nod to their lifestyle interests, BBC Good Food is a top site (nearly 2.7× index) – these folks are looking up recipes for that post-Pilates protein bowl. The contrast is clear: to reach PureGym people, go social, go mobile, go entertainment; to reach David Lloyd’s people, mix in credible news channels, LinkedIn, and lifestyle content. It’s a fingerprint in media that reflects each brand’s ethos – one loud and viral, the other measured and informative.

Strategic Takeaways for Marketers

So, what should marketers learn from this data duel? Stop lumping all “fitness enthusiasts” together – the data shows distinct tribes. Here are the key takeaways:

- Different Personas, Different Messages: A PureGym prospect might respond to edgy, fast-paced content (meme campaigns, influencer challenges on TikTok). A David Lloyd prospect will need a premium, trust-building approach (think inspirational wellness stories or LinkedIn thought leadership about work-life balance). Tailor your creative tone accordingly.

- Channel Strategy is Everything: PureGym’s audience lives on social and streaming platforms – allocate spend to Instagram, Snapchat, YouTube, and even in-gym Spotify playlists. David Lloyd’s audience consumes broadsheet news, LinkedIn, and niche lifestyle media – consider press ads or sponsored articles in The Guardian, and target LinkedIn for corporate membership deals. One-size-fits-all media plans will waste budget; use these insights to put money where your audience actually is.

- Geo-Target for Impact: Leverage geographic hotspots. For PureGym, doubling down on campaigns in Leeds, Bradford, Manchester (and similar urban centers) will hit a concentration of your core audience. For David Lloyd, you’d focus on affluent pockets – think suburban London (Surrey, Kent) and prosperous towns like Bury St Edmunds or Eastbourne. Out-of-Home advertising or local events should align with these strongholds – e.g., a PureGym popup at a city shopping centre vs. a David Lloyd tie-in at a county golf club. The goal is to meet your audience where they already are.

Above all, ditch the guesswork. These insights prove that relying on stereotypes (e.g., “gym goers are all young urbanites” or “premium club members won’t be on social media”) can mislead your strategy. The reality is nuanced – and when you tap into real behavior data, you find opportunities to connect in the right place, time, and context.

Data Beats Intuition

At Skyrise, we believe data beats intuition – every time. This Battle of the Brands: Fitness Edition was a prime example. It’s our slightly provocative reminder to marketers: if you’re still making campaign decisions based on hunches or broad demographics, you’re missing the mark. Geo-temporal audience data like this turns conventional wisdom on its head and gives you a competitive edge. Our point of view is simple: stop guessing – start knowing.

Ready to put these insights into action for your brand? 💡

Whether you’re Team PureGym, Team David Lloyd, or fighting your own market battle, Skyrise can arm you with the real-world audience intel to win.

Connect with us to discover your brand’s unique audience fingerprints and drive marketing that actually moves the needle. It’s time to flex your data muscles – let’s get to work!